Tax Service Integration – Avalara AvaTax

Expandable’s integration to AVALARA AVATAX eliminates the complexity of determining taxes across multiple jurisdictions by automatically calculating the final sales tax amount on each invoice.

With Avalara’s comprehensive cloud-based sales tax calculation engine, Expandable users can more accurately manage various tax rates and remain up-to-date on increasingly complicated tax regulations.

MODULE FEATURES

Eliminate Table-based Tax Calculations

Referring to and maintaining tax tables for multiple jurisdictions can be an error-prone process, especially in precincts where tax rates may vary by city and county.

AvaTax is Avalara’s industry-leading Software as a Service (SaaS) real-time sales tax solution that delivers accurate, real-time sales and use tax calculation.

Integration with Expandable provides customers the option of eliminating tedious tax table maintenance in favor of automated tax rate calulations that improve compliance and efficiency.

Real-time Tax Rate Calculations

- Accurate tax rates automatically applied to each transaction

- Current rates and rules calculated instantly

- Full statutory compliance

- Built-in address verification

- On-demand reporting

Sales Tax Service Integration

- Tax Address Validation

- Sales Tax Services

- Shipped not invoiced and returned not credited

- RMA status

- Sales Tax Service integration supports:

- Product Tax: Avalara product service codes part and product line level

- Customer Exemptions: Avalara tax usage type or tax exemption number

- Global customers: Avalara Tax service VAT codes

Integration Points

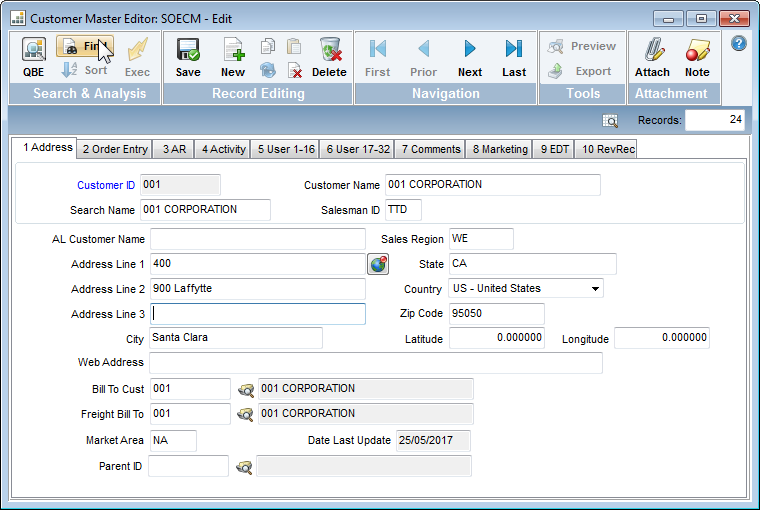

The Expandable integration to AvaTax includes address validation for the following Expandable master editors:

- Customer Master

- Vendor Master

- Employee Master

- Stores Master

- Company Editor

Integration to AvaTax includes address validation for the Customer Master Editor