Foreign Currency

Expandable FOREIGN CURRENCY provides complete control of currency exchange rates, currency by trading partner and currency rate fluctuation gains and losses, realized and unrealized.

Foreign Currency maintains the exchange rate information to allow purchase order, accounts payable invoice, sales order and accounts receivable invoice financial values to be tracked in both the currency of the supplier or customer and in local currency.

Realized currency gain and loss values are calculated at the time of payment generation in Expandable Accounts Payable and payment application in Expandable Accounts Receivable.

All general ledger transactions created in subsidiary systems carry local currency financial values to the General Ledger.

Foreign Currency also includes the ability to calculate and track VALUE ADDED TAX (VAT).

MODULE FEATURES

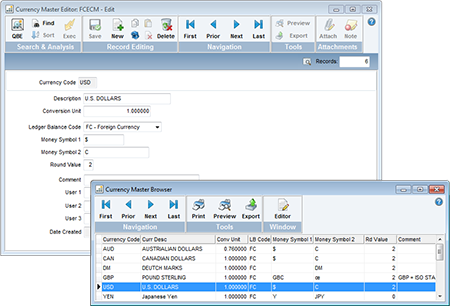

Currency Code Maintenance

- Supports ISO International Standard 4217

- Two money symbol fields

- Rounding factor control

- Conversion unit of measure to support inflationary currencies

Currency Exchange Rate Maintenance

- By effective date

Multiple Banks Supported

- By currency

- Unique GL accounts by bank

General Ledger Accounts

- By currency

- Re-valuation method and accounting

Customer Pricing

- Two methods supported:

- User-defined price books for foreign currencies

- System-generated conversion factors for calculating appropriate foreign currency prices

- Automatic conversion of local currency prices to currency on sales orders and purchase orders

- Maintain and print price lists in individual currencies

Vendor Part Cross-references Maintained with Foreign Currency Prices

Extensive Reporting

- Currency code selection

Ledger Balances

- By local or base currency Financial reporting in either local or base currency

Bank Service Charge Entry

- Accounts payable hand check entry

- Accounts payable stop payment entry

- Accounts payable cleared checks entry

- Accounts receivable remittance entry

Automatic Month End Revaluation

- General ledger accounts

- Gain/loss calculation with optional reversal

- Accounts payable vouchers

- Unrealized gain/loss calculation with optional reversal

- Accounts receivable invoices

- Unrealized gain/loss calculation with optional reversal

- Unapplied checks

- Report only option without updates

Journal Voucher Control

- Amounts in foreign, local and base currencies

- General JV entry

- Recurring/standard journals

- Skeleton/template journals

- Automatic reversing option

Set your currency attributes using the Currency Master Editor

Value Added Tax

Tax Code Maintenance

- Alpha/numeric three digit codes

- Effective date control

- VAT description to 24 characters

- VAT rate up to 99.9999 percent

- Default VAT department and account number

VAT Effective Date Logic for Correct Rate

- Purchase order entry and maintenance

- Sales order entry and maintenance

- Accounts payable and accounts receivable entry